Unless you understand this formula, time is fixed, it’s something you can’t get back.

As a kid we grow up with these expectations which almost don’t allow for questioning: go to school, get a job, find a partner, buy a house with a white picket fence, have a baby, become a grandparent, done. It seems like a question everyone has answered without even asking themselves of something so vitally important.

These 5 questions are the ones I believe are most crucial in thinking about how you want to spend your time without mindlessly following the masses.

- Do I really want to be a parent?

- Relationship

- Do I need to buy a house?

- Career / Money

- Why am I alive? If I retired today, what would I do?

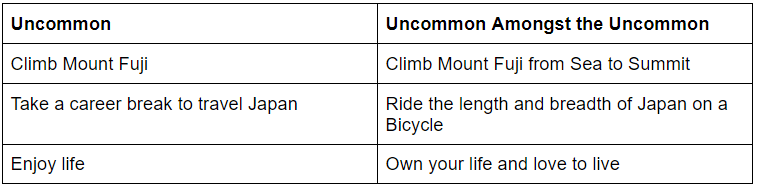

I don’t always take the most orthodox approach to life and that’s purely due to asking myself questions and tossing up the opportunity cost (considering all options) in terms of time and selecting the best option.

1. Do I really want to be a parent?

Yes or No? I believe this is the most important question that people really need to ask themselves. If you get this terribly wrong not only can you severely alter your own quality of life, but also the next generation’s life.

Just like anything involving decisions and opportunity costs, I would recommend making your own table of pros and cons. I generally start with the cons.

Cons

- Time commitment

- Short temper / lack of patience

- Cost to the environment

- Cost to my wallet

Pros

- Live vicariously through your kids

- Can bring a lot of joy

- Naturally paternal / maternal

- Give you something to do

For some it will be clear after putting a simple list together. For others, more research may be needed. Luckily for me, I have 2 brothers with 3 kids each. A simple visit to each house gave me solid insight into the life of being a parent.

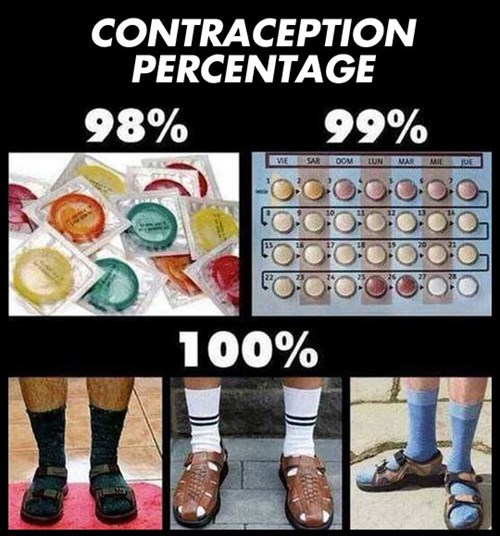

Personally, the time commitment was the killer for me. I like my life, I like spending time on me, I do what I want (which is what the wife also wants). If a kid came into my life, almost all of my time for the foreseeable 18 years would go into that kid away from me. Yes, I’m selfish but that’s how I want to live MY life, your life is your choice. Communication is also key, talk through these things with your partner before you get married or get too deep.

Remember your life is crafted by your own choices, be inquisitive and know how you want to spend your time to live the life you want to live.

2. Is this the right relationship for me?

- What kind of relationship am I looking for?

- Why am I with this person?

- Do I want to get married?

Firstly be honest with yourself and then communicate and be clear with your partner. Know what kind of relationship you want: is it just fun? Serious? Nothing? It’s up to you. Pick one and be clear, there is nothing worse than being in the ‘grey zone’ – keep it black or white.

If you are lying to yourself and your partner, you are wasting 2 people’s time and effort.

3. Do I need to buy a house?

In Australia it seems like another rhetorical question… But why do we want to be house owners? Just to be clear, I’m not against buying a house, I just think it’s most important to consider your situation and timing in relation to buying. I’ve listed some pros and cons below.

Buying

The Cons of Buying: It’s a big commitment of money, but responsibility as well. It may also lock down your options for working hours, holidays and other commitments whilst putting further stress on the purchaser.

The Pros of Buying: You are an owner – you can do almost whatever you want with the place, you have a secure place to live so no one can really kick you out. The price of the house (most likely) will rise in value – so you can make money on the purchase.

Renting

Pros of Renting: Cheaper initial cost and little upfront investment (bond), freedom to move places if you don’t like the location or house. If you go on an extended holiday, you will pay no rent (i.e you can literally move anywhere in the world).

Cons of Renting: Can be forced to move out of home. Rent increases are inevitable. You will be ‘paying for someone’s mortgage’ (although I don’t believe this to be any different to being employed).

My wife and I purchased an apartment in Sydney in 2019. We both actually love the apartment & amenities as well as the location (closeness to shopping, national parks, safety, etc). We have seen so many benefits in terms of tax, rental income and getting experimental on the tools. Doubts about the purchase have only recently come to mind as we plan out the next few years in a post-covid world where we would like to work and live internationally and having a large asset back in Sydney is a bit of an obligation.

4. How much money is enough?

This is almost the same as when can I retire? Do I need to keep working until I’m at retirement age? I want to challenge the thinking here – especially to those who are not planning on kids. An idea which I autonomously thought of but which is well documented by Bill Perkins is below:

What’s your optimum retirement strategy? Are you going to just keep working long hours in order to sock away more and more money that you’ll never get around to spending because you’re working?

The Die With Zero philosophy is once you’ve saved enough to fund your retirement and give to your family and charities, you should start focusing more on generating memorable life experiences. That’s the time to live life to its fullest, not to be pulling even longer hours in the office, or waiting until you’re too old to be able to enjoy doing things.

https://summaries.com/blog/die-with-zero

In the end, how much help do you need to give to your kids? If you’ve raised them to be self-sufficient, I’m sure they will be okay on their own or with just a little support. You’ve worked hard to earn this money, go enjoy your money and don’t end up with a James and Lily Potter amount of money left over without being able to spend and enjoy it.

5. What is MY life?

Imagine a life without having to worry about time or money or anything else. What would you do? What do you enjoy? Where do you WANT to spend your time?

This is how I like to think about ‘the meaning of life’ – my meaning is to enjoy life with the people I care about. Is there another life? No idea, but what I do know is I will live now and die one day and I will enjoy the hell out of it.

Have a good solid think and figure out the things you love to do which bring joy to your life. For me this is:

- Life planning

- Short Term: Planning my next few days, next holiday, mapping a new trail run / bike ride, blog writing etc

- Long Term: Exploring google maps for holidays, Expense / qantas point planning, investigating long holidays, blog planning, etc

- Travel

- Running / Hiking / Nature

- Anime, gaming and computers

- Collecting (cards) and creative hobbies

If I were to retire tomorrow I would honestly be up until at least 3am ‘life planning’, I call it. Which would just be on my custom build PC throwing ideas on a spreadsheet in timeline format and tossing up ideas of which one sounds best and works best with my current situation and timings. No doubt those plans would include each of these dot points. The next morning I would run the wife through these plans and see if she’d be keen on them – that is my/our life and I love it.